Author: Executive Director Kent Kupfner

Although the United States remains one of the six major global wheat exporters, our market share has been trending lower for the past 22 years. Over the past decade, the United States has given up market share to competitors such as Canada, the EU, Russia, Ukraine, and Australia. Drought and grower preference for crops offering superior returns per acre, such as corn, soybeans, canola, and pulses, may further reduce US wheat production and exports in the future.

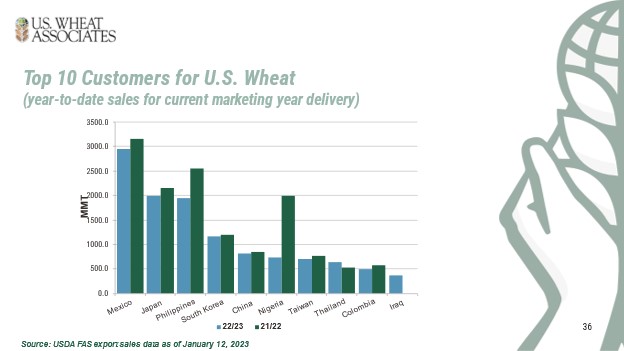

Major US wheat export destinations have been shifting since the turn of the century. For instance, export volumes to Egypt have all but completely disappeared, while shipments to Mexico and many Asian countries have increased.

One bright spot for US exports is South Korea. This is particularly positive news as it relates to the demand for Montana winter and spring wheat. In the past 60 years, South Korea has transitioned from a primarily rural, agriculturally-based society into an urban and industrialized economy. Electronics, textiles, steel manufacturing, automobiles, and shipbuilding are primary industries. South Korea is also one of the world’s largest producers of microchips.

The majority of South Korea is mountainous, with less than 25% of its land utilized for agriculture. Small, family farms primarily growing rice are the predominant farming operations. Production agriculture represents only a small fraction of the country’s population and only 1.8% of the gross domestic product.

Although South Korea produces a significant amount of rice, wheat production is very limited, leaving the country heavily dependent on imports of grains such as wheat and corn. South Korea’s self-sufficiency rate for wheat is under one percent. This year, wheat imports are projected to reach 4.2 million metric tons (MMT), comprised primarily of supplies from the US, Australia, and Canada. Of this total, milling wheat is forecast to be 2.8 MMT and feed wheat 1.4 MMT.

As South Korea’s disposable incomes continue to grow, the population is increasingly looking for convenient foods such as instant noodles. This translates into increased demand for Montana’s hard wheat crops, widely recognized for their superior end-use characteristics.

During a recent trip to S. Korea coordinated by US Wheat Associates, Montana Wheat and Barley Committee (MWBC) Board Member, Keven Bradley, a Cut Bank wheat producer, and me, were able to meet with the Korean Flour Millers Industry Association (KOFMIA). This was an excellent opportunity to learn more about the South Korean milling industry and gain further insight into their demand for high-quality, US wheat. It also afforded the chance to thank these customers for their consistent demand and procurement of US wheat cargo. It’s important to keep in mind that US wheat is significantly more expensive than other global origins, however, US wheat still enjoys nearly a 50% market share of the countries milling wheat imports.

The South Korean flour milling industry is made up of seven major companies and the US Wheat Team was fortunate to be able to meet with representatives of six of these flour mills. These companies included Deahan Flour Mills, Daesan Flour Mills, Samyang Corp., Korean Flour Mills, CJ CheilJedang, and Samhwa Flour Mills.

The MWBC would like to reiterate our appreciation for their hospitality while in South Korea and thank them for their continued business. We will be hosting a Korean trade team in Montana this summer and we’re looking forward to showing our valuable customers that Montana consistently produces the highest quality hard wheat in the world.