Author: Executive Director Kent Kupfner

There is a quiet and currently subdued bullish factor lurking just below the surface of the spring wheat market. It is likely to start rearing its head in a more pronounced way and exerting more influence in the coming weeks.

Weather is currently the single largest swing factor influencing Hard Red Spring (HRS) markets. The drought conditions impacting large swaths of the Southern Plains are widely known and a very important fundamental for wheat markets, Hard Red Winter (HRW) in particular. Recent crop ratings cite Kansas HRW conditions as 52% poor to very poor. 100% of Nebraska’s HRW acres are experiencing drought conditions.

Perhaps the weather factor garnering the least attention is the current snowpack and lingering cold temperatures prevalent across much of the Northern Plains, especially in North Dakota and Minnesota. It is just early April, but delayed planting can have a significant impact on markets. In the case of a prevent plant scenario, this has the potential to be explosive given the underlying fundamentals unique to HRS.

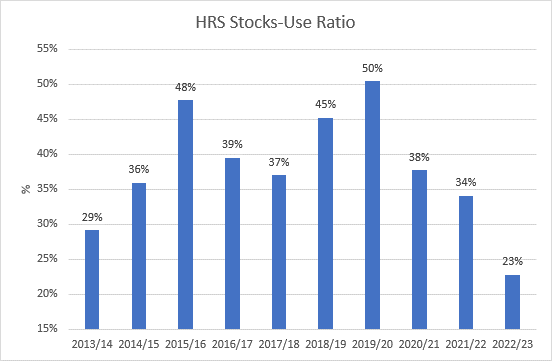

All wheat ending stocks are at 15-year lows. Ending stocks of HRS in both the US and Canada are historically tight. Note the attached charts showing North American HRS ending stocks at their lowest level in ten years. One of the most important fundamental indicators to consider is the stocks-to-use ratio. The US all-wheat class stocks-to-use ratio is relatively comfortable at 30%. However, when analyzing HRS specifically, the stocks-to-use ratio is trending lower and has dropped to 23%. This ultimately begs the question: Is the market setting up for potential production issues that could drive the HRS stocks-to-use ratio into the teens?

A stocks-to-use ratio in the teens would be historically low and intensifies the spotlight on HRS acres and growing conditions. Given these supply concerns, HRS simply has little room for error. For some perspective on what can occur when stocks-to-use ratios dip into the teens, one only must look back at the extreme market volatility during 2007-08. The markets will perceive any threat to production and attempt to price in that risk. The markets will likely react or overreact quickly to all weather-related issues, whether its dry conditions in parts of Montana and portions of the Canadian Prairies or too wet resulting in delayed planting in the Dakotas and Minnesota.

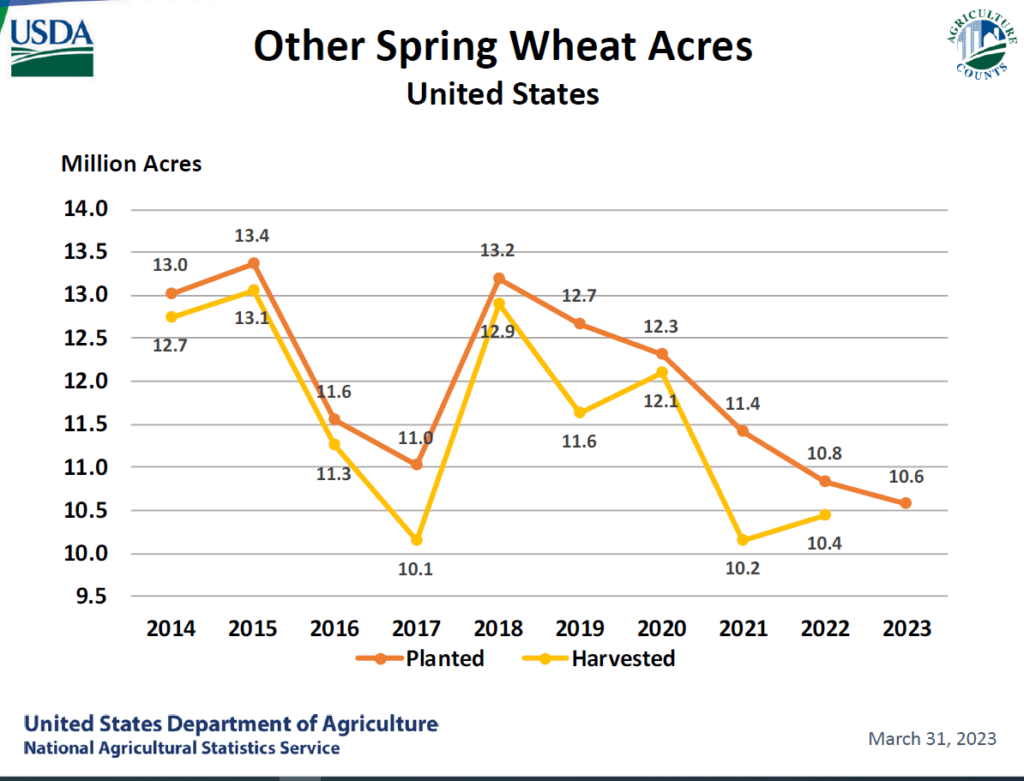

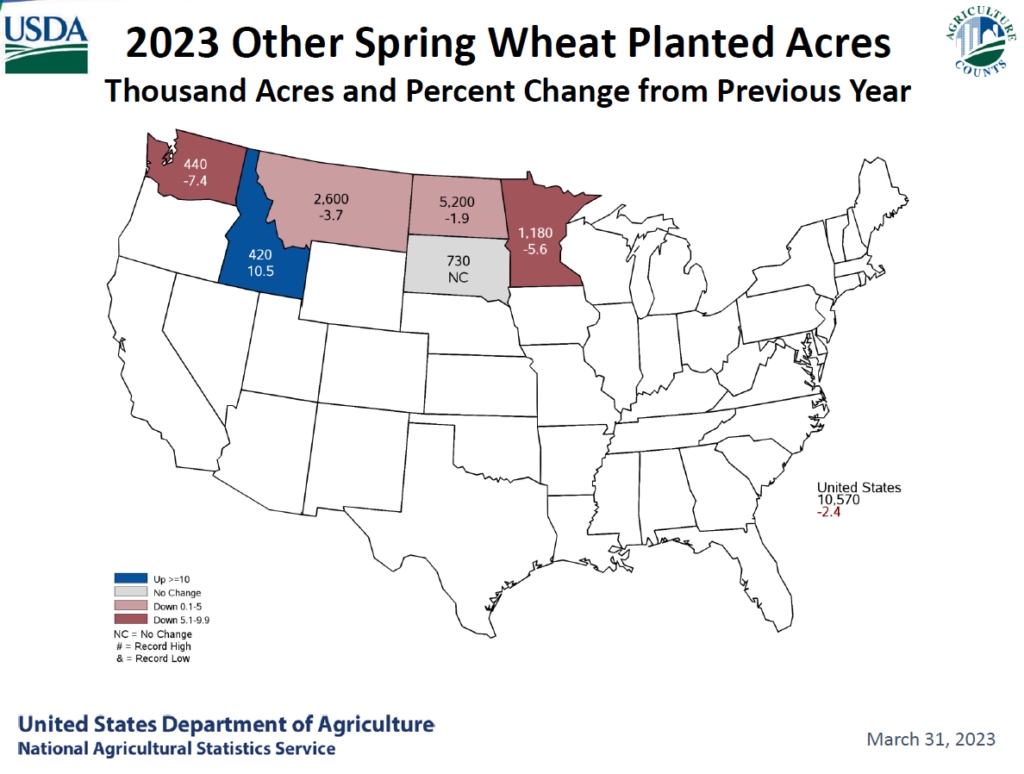

With US HRS planted acreage estimated to be down 2.4% from last year, the delayed planting issue becomes even more pronounced (see attached chart). Spring wheat acreage, other than durum, totaling 10.57 million acres, is projected to be the lowest since 1972. Planted acreage for every major HRS producing state, except South Dakota, is projected to be lower. Montana’s producers are projected to plant 2.6 million acres, which is down 3.7%.

As is typical, the markets will closely monitor North American seeding progress and subsequent crop development. However, given the unique, fundamental makeup of HRS, the potential for extreme volatility most certainly exists.